User Registration

The user registers and creates an account by providing the necessary details and completing KYC(Know Your Customer) and AML (Anti Money Laundering) procedures.

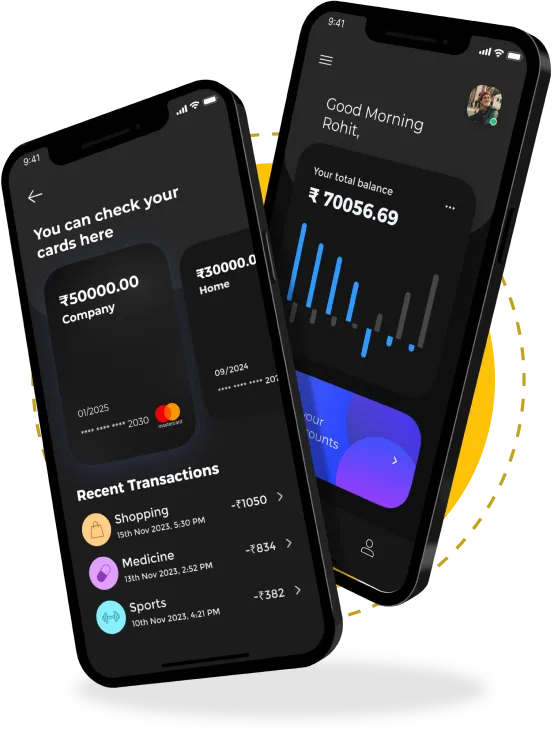

Wallet Management

The software provides digital wallets for users to store, send, and manage their cryptos securely. Each wallet has private and public keys for crypto transactions.

Transaction Processing

Users can initiate transactions to transfer cryptocurrencies. The software verifies and processes these transactions and ensures they are recorded in the blockchain.

Blockchain Integration

The software incorporates multiple blockchain networks to facilitate real-time transaction processing and ensures transparency and security.

Security Measures

The software is incorporated with robust security protocols such as two-factor authentication, encryption, digital signature wallets, and regular security audits to protect user assets.

Lending Services

Some crypto banking platforms provide interest-earning accounts, which allow users to deposit cryptocurrencies and earn interest. They may also offer lending services, allowing users to borrow against their cryptocurrency assets.

Crypto Exchange Integration

Crypto banking software integrates with crypto exchanges, allowing users to trade cryptocurrencies directly from their banking platform.

Customer Support

Crypto banking platforms offer customer support to help users with accounts, transactions, and other issues. Now let’s see why financial institutions, organizations, and startups should invest in crypto banking platforms.